To Roll or Not to Roll (Rollover IRAs)

Some points to consider:

1) Likely the biggest distribution question that a 401(k) participant asks is: should I rollover the proceeds to an IRA or retain it within the 401(k), assuming the plan sponsor allows that? There is no certain answer to this question, although in the majority of situations, it is preferable to roll the proceeds because of participant control of the account. See Willis, Nick, or Keith to begin the paperwork for a Rollover IRA.

Some points to consider:

1) Likely the biggest distribution question that a 401(k) participant asks is: should I rollover the proceeds to an IRA or retain it within the 401(k), assuming the plan sponsor allows that? There is no certain answer to this question, although in the majority of situations, it is preferable to roll the proceeds because of participant control of the account. See Willis, Nick, or Keith to begin the paperwork for a Rollover IRA.

2) If electing to roll to an IRA, make sure it is a DIRECT rollover and not an INDIRECT rollover. A DIRECT rollover includes a check made payable “FBO” (for the benefit of) the retiring participant. An INDIRECT rollover includes a check to the retirement participant by name and is taxable if the distribution proceeds is not replaced after 60 days from the date of the check.

3) Rollover vs. Traditional IRA: A Rollover IRA has unlimited asset protection (ERISA protection) whereas a Traditional IRA is limited in asset protection to only a $1.0 million indexed amount in personal bankruptcy. Also, a Rollover IRA is not limited to $6,500 per year contribution plus $1,000 catch-up contribution as is a Traditional IRA.

4) Some participants will use a Conduit IRA, where they roll the 401(k) proceeds to a separately-established IRA, and then, assuming the new plan terms allow, roll the proceeds into the new 401(k) (or other employer plan) after finding a new job. The 401(k) proceeds retain ERISA asset protection within the Conduit IRA. However, new contributions to the Conduit IRA may not be accepted under the language of the new employer plan.

5) 401(k) and other qualified plan proceeds can be rolled directly to a Roth IRA (without having to establish a Conduit IRA), although only the after-tax portion can be rolled.

6) A major advantage of leaving the proceeds in the 401(k) plan is, if there is employer stock in the 401(k) portfolio, the stock, once distributed, is eligible for favorable net unrealized appreciation (NUA) tax treatment. This is not possible if the stock is rolled to a Rollover IRA and is then distributed from there!

7) Another major advantage of leaving the proceeds in the 401(k) plan is the preservation of the ability to take a loan from the 401(k); you can NEVER take a loan from any type of IRA, personal or employer-sponsored, such as a SEP-IRA.

8) It is important to understand what is meant by the term “qualified distribution” from a Roth IRA and the tests that must be met: this essentially means that the retiring participant is disabled, deceased, or the distributed proceeds have been held in the Roth IRA for at least five years from the date of the first contribution. As a general rule, contributions and conversions from a Roth IRA are not taxable at the time of distribution, however, the earnings from both an original or converted Roth IRA may be taxable. It is also possible that earnings from both may be subject to the 10% early distribution penalty unless meeting a statutory exception.

9) There are NO required lifetime minimum distributions from a Roth IRA as is the case with a traditional deductible or non-deductible IRA. (There are post-death RMDs from a Roth IRA but these are usually non-taxable.)

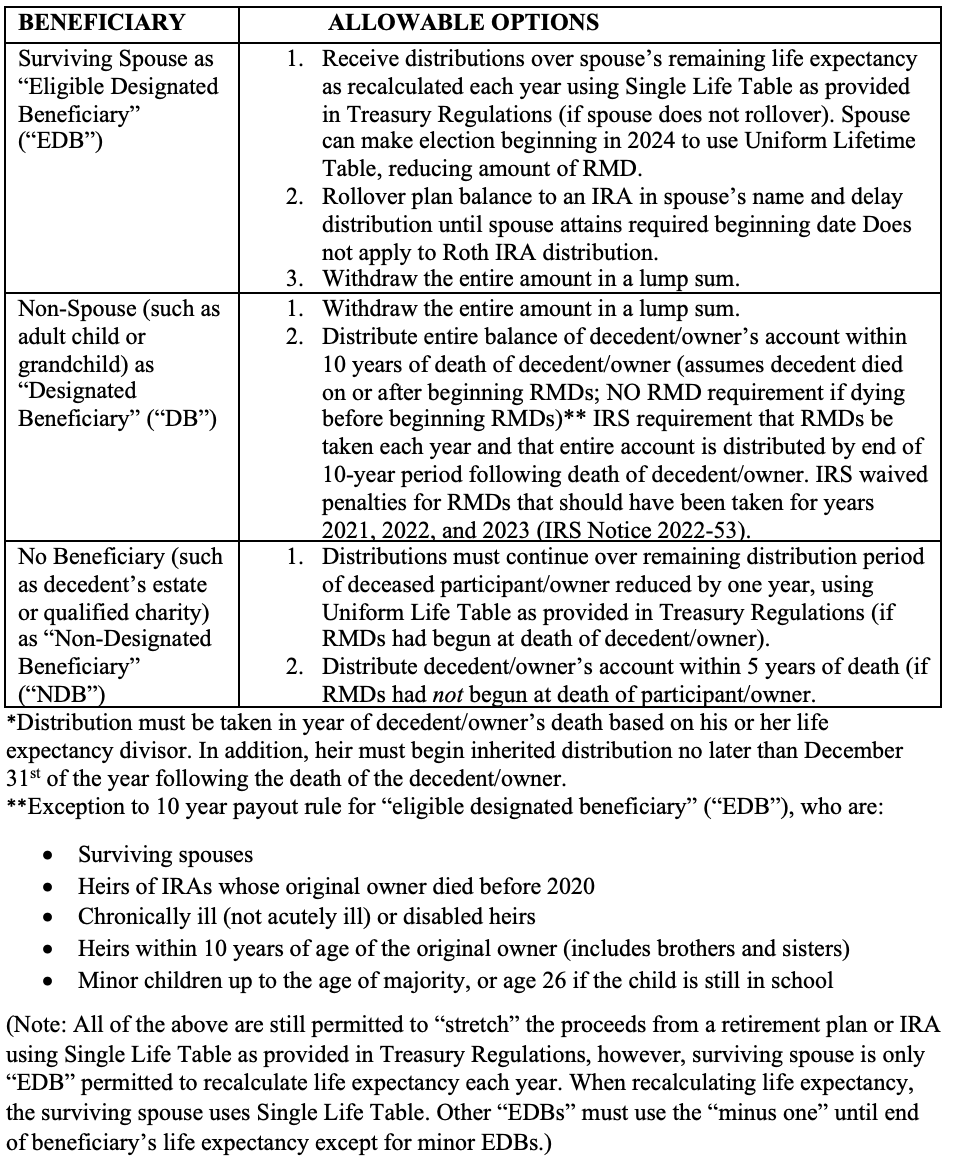

10) Beginning in 2020, a non-spouse beneficiary of an inherited IRA has LOST the ability to “stretch” the distribution and is generally limited to no more than a 10 year payout form the date of the owner’s date of death. (Under Treasury Regulations, a payout must be made in each of the 10 years, rather than all-at-once in year 10.) The major exception to this rule is a surviving spouse as an “eligible designated beneficiary” (EDB) who retains the ability to roll to his or her own IRA and “stretch” the distribution over his or her lifetime.

11) Generally, a designated Roth account, such as a Roth 401(k) or Roth 403(b), may only be rolled to another designated Roth account. (This necessitates the employer previously establishing a designated Roth account for the benefit of employees.) Also, a participant can only roll a SIMPLE IRA to another SIMPLE IRA. It is possible to roll a SIMPLE IRA to a traditional IRA but only after 2 years of SIMPLE plan participation.

12) Designated Roth accounts are subject to the required minimum distribution (RMD) rules in 2023, including those with a required beginning date of April 1, 2024. However beginning in 2024 and later, RMDs are no longer required from designated Roth accounts.

5105 DTC PKWY Ste 316

Greenwood Village, Colorado 80111 United States

5105 DTC PKWY Ste 316

Greenwood Village, Colorado 80111 United States